Last week, Q1 gross domestic product (GDP) and personal consumption expenditures (PCE) numbers were center stage as markets finished up after a volatile week:

- The S&P 500 was up 2.67%

- The Dow Jones Industrial Average was positive by 0.67%

- The tech-heavy Nasdaq Composite had the strongest week, finishing up 4.23%

- The 10-Year Treasury closed at 4.67%

On Tuesday, the Manufacturing and Service Purchasing Managers’ Indices (PMIs) were released for the month of April, providing insights into both sectors. Recent PMI readings came in lower than expected, depicting a disruption to the previous expansion territory trends, and are now contrarily pivoting.

The Census Bureau released their durable goods orders report for the month of March on Wednesday, measuring the change in the total value of new orders for long-lasting manufactured goods. For the second consecutive month, the reading for the month came in stronger than expected, signaling a bullish market for the industry. Additionally, crude oil inventories numbers were released, depicting an increase in demand and a strong possibility of price increases for oil.

On Thursday, the Department of Labor published the number of people who filed for unemployment insurance during the past week in the initial jobless claims measurement. Current trends show the labor market is in expansion territory due to the previous three readings decreasing in the filing of initial jobless claims each month. That same day, GDP numbers for Q1 were released. A year ago, in April 2023, GDP came in at 1.1%. April 2024’s GDP reading came in at 1.6%, showing improvement in the economy in a year’s time, however, significantly lower than predicted and compared to January to March 2024 readings. Economists will be on the lookout to see if the economy is continuously improving or possibly slowing down.

Closing out the week on Friday, the PCE Index for the month of March was released. Economists were yet again relatively successful in predicting the previous month’s reading, which came in at 0.3%. This measure provides some helpful insights into the Fed’s preferred inflation indicator. That same day, the University of Michigan released their Consumer Expectations reading for the month of April, gauging how consumers feel about the current state of the economy. The reading was forecasted to come in at 77; however, it came in at 76, depicting an expectation of a slight decline in the current economic status.

Closer Look at Gold

In the past year, the value of gold has seen a significant rise of almost 20%, with its price exceeding $2,000 per ounce, a level not seen since January 2020. The World Gold Council reports that since 1971, when the U.S. abandoned the gold standard, the price of gold has consistently grown approximately 8% annually in terms of the U.S. dollar.

The essence of gold is rooted in its unique dual character. Gold serves not only as an investment asset but also as a consumer product. However, the appeal of gold as an investment asset is often questioned, as it does not generate income like traditional assets such as stocks, bonds, or real estate. This dual nature, often overlooked in favor of traditional asset classes like stocks and bonds, allows gold to offer a blend of characteristics that can enhance portfolio performance. Such portfolio enhancements include its capacity to act as a safeguard against inflation during times of instability, its varied supply and demand factors, and its high liquidity.

Gold is traditionally seen as an effective hedge against inflation. This claim is supported by a report from the World Gold Council, revealing that gold has consistently outperformed both U.S. and global consumer price indices (CPI) since 1971. Furthermore, over the period spanning 1971 to 2023, gold has served as a hedge against high inflation, as evidenced by its price rising approximately 8% annually when inflation rates ranged between 2% and 5%. This increase was even more pronounced during periods of higher inflation, with gold’s price surging around 25% when the CPI exceeded 5%. Moreover, this inflation-hedging characteristic of gold is particularly valuable in the current macroeconomic landscape, where concerns over rising prices persist.

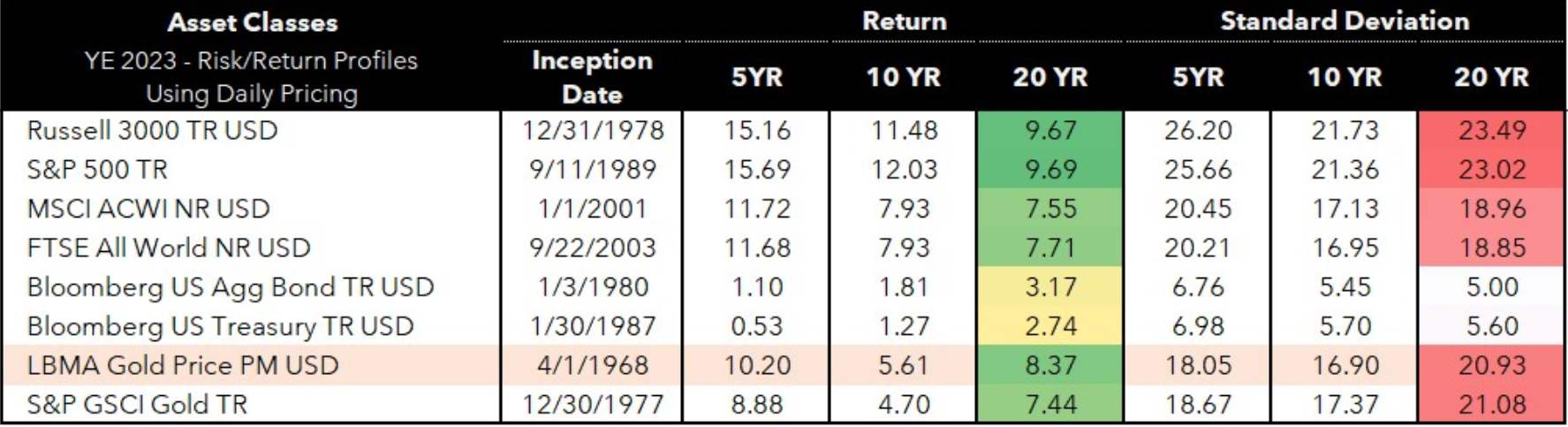

Source: Morningstar Direct

Over the past two decades, on a total return basis, gold has delivered returns comparable to global equities while outperforming bonds, as depicted by the LBMA Gold Index. Although gold’s performance has lagged behind domestic equities during this period, it has exhibited lower volatility. However, reviewing its performance during market downturns sets gold apart from its peers.

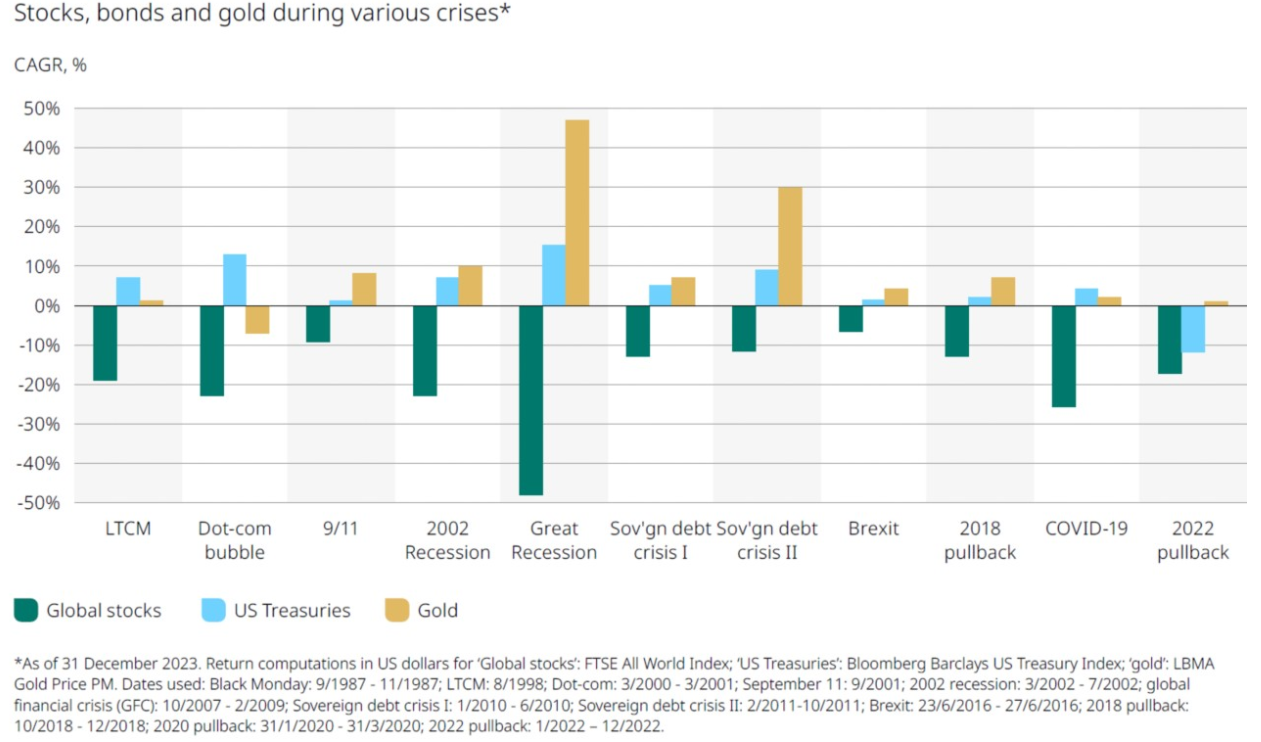

Gold, with its ability to diversify portfolios and offer protection during downturns, serves as an effective hedge during market downturns. Its performance typically inversely correlates with equities and other risk assets, a trend evident during the Global Financial Crisis, the 2018 pullback, and the market downturns during COVID and 2022, where it yielded positive returns while most assets declined.

Source: World Gold Council

Unlike fiat currencies like the U.S. dollar, which can be printed in unlimited quantities, gold’s supply grows at a modest pace of around 1.7% annually. This natural constraint on supply, coupled with gold’s universal acceptance as a medium of exchange, has enabled it to outperform major currencies and commodities in terms of preserving its value over time. On the demand side, the World Gold Council reported an average annual net demand for gold of 3,126 tonnes, or approximately $195 billion, in 2023. This demand is distributed among investment (39%), jewelry (35%), central banks (19%), and technology (7%). Central banks’ demand remained high, with purchases in 2022 and 2023 reaching 1,136 and 1,037 tonnes, respectively, the highest since 1971.

Per the World Gold Council, gold has a global market worth about $6 trillion and daily trading volumes exceeding $163 billion in 2023. The gold ETF market had an average trading volume of around $2.1 billion in 2023. Physical gold holdings by investors and central banks were estimated at about $5.1 trillion, with an additional $1.0 trillion in open interest through derivatives. Unlike many financial markets, gold’s liquidity remains stable, even during market downturns.

Investing in gold, despite its benefits, has challenges.

Gold’s valuation does not align with standard discounted cash-flow (DCF) methodologies for equities or bonds, as it does not generate cash flows or dividends. While gold is a less volatile asset than equities, commodities, and alternatives, it has experienced significant price swings in the past. In some years, it has posted close to 30% gains (in 2010), while in other years, it has posted close to 30% losses (in 2013). This implies that gold has an asymmetric correlation profile with equities, meaning it performs much better when equities fall than it does poorly when equities rise.

Gold can enhance portfolio resilience through diversification and potential inflation hedging. However, its lack of cash flow and inherent volatility require careful consideration. While it could have the potential to outperform equities during market downturns, it may be subject to price fluctuations. Ultimately, the inclusion of gold in a portfolio should be based on an investor’s tolerance for risk and their long-term financial objectives.

Index: The LBMA Gold Price PM Index measures the performance of setting price of gold, determined twice each business day on the London bullion market by the five members of The London Gold Market Fixing Ltd. It is designed to fix a price for settling contracts between members of the London bullion market, but informally the gold fixing provides a recognized rate that is used as a benchmark for pricing the majority of gold products and derivatives throughout the world’s markets.

Consumer confidence for the month of April will be gauged on Tuesday through the Conference Board’s Consumer Confidence measure. Readings from the previous two months have been on a decline, indicating decreasing consumer confidence in the economy. That same day, the American Petroleum Institute (API) will release their weekly crude oil stock measurement. An increase in inventories implies a weaker demand and a possible decrease in prices. Contrarily, an increase in demand could lead to an increase in petroleum prices.

Wednesday, ADP will publish their National Employment Report measuring the monthly change in non-farm, private employment, based on their clients’ payroll data. A number that is stronger than forecasted is bullish, while a weaker forecast is bearish for the labor market. Additionally, the Job Openings and Labor Turnover Survey (JOLTS) will report on the current job vacancies, collecting data from employers regarding their employment status and job postings. April’s reading showed 8.76 million open positions, indicating a bearish job market compared to the end of March with 8.86 million job openings.

On Thursday, the Nonfarm Productivity measure will be released, annualizing the change in labor efficiency when producing goods and services. Higher productivity increases the ability to raise wages. Concurrently, unit labor costs will also be released, annualizing the change in prices that businesses pay for labor, excluding the farming industry, which is a leading indicator of consumer inflation.

Concluding the week on Friday, the average hourly earnings for each month will be released, measuring the change in the amount of money businesses pay for labor, excluding the agricultural sector. Furthermore, the unemployment rate will reveal the percentage of the total workforce that is not working, but actively seeking employment. Currently, economists are predicting no change in the unemployment rate at 3.8% from the previous reading.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.