Week in Review…

Major market indices closed the week lower as new U.S. data sparked concern among investors over a slowing economy and sticky inflation, leading them in search of safer assets.

- The S&P 500 declined by –1.66%

- The Dow Jones Industrial Average declined by –2.51%

- The tech-heavy Nasdaq declined by –2.26%

- The 10-Year Treasury yield closed at 4.43%

Last week was shorter for the U.S. market due to Presidents Day on Monday, but it was still packed with key economic data releases.

On Wednesday, the Fed Minutes showed that officials are generally at ease with their decision to keep interest rates unchanged from their recent meeting. They didn’t indicate any immediate shifts in their cautious approach to rate cuts. Following January’s meeting, Fed Chair Jerome Powell mentioned that the central bank would require “real progress on inflation” or an unexpected downturn in the labor market before considering further rate reductions.

In terms of the housing market, U.S. existing-home sales dropped by 4.9% in January compared to the previous month, landing at a seasonally adjusted annual rate of 4.08 million, as reported by the National Association of Realtors on Friday. Elevated home prices and mortgage rates continued to weigh on sales throughout January, discouraging many potential buyers. Some first-time homebuyers have found themselves priced out, while existing homeowners are opting to stay in their current homes rather than give up low mortgage rates.

Additionally, we saw the consumer sentiment index from The University of Michigan fall sharply to 64.7 at the end of February, down from January’s reading of 71.7. The survey highlighted particular concerns regarding buying conditions for durable goods, products designed to last at least five years, largely driven by fears of imminent tariff-related price increases.

Finally, the services and manufacturing purchasing managers’ index (PMI) indices were released. The services sector experienced expansion for the seventh month in a row in January, marking the 53rd month of growth since the economy began recovering from the pandemic-induced recession in June 2020. Meanwhile, the manufacturing sector showed signs of growth in January, ending a 26-month stretch of contraction.

Spotlight

Social Media’s Financial Gurus:

Are They Leading You to Fortune or Folly?

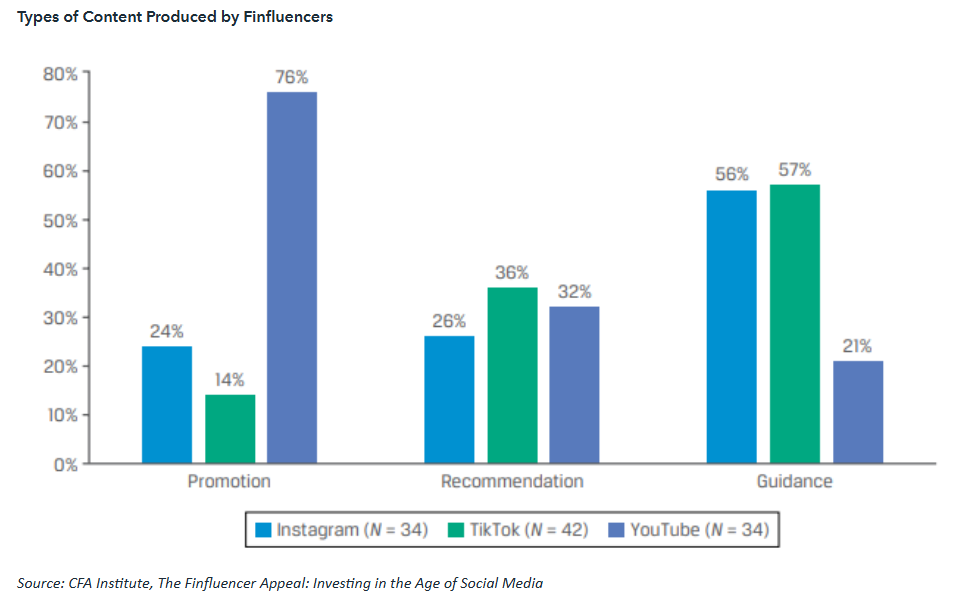

Financial influencers (finfluencers) have gained significant popularity in recent years, leveraging social media platforms to share investment advice and insights. According to Wesleyan’s The Next Step, finfluencers have taken social media by storm, particularly on platforms like TikTok with trends such as “FinTok”. While finfluencers make complex financial concepts more relatable and accessible, they often lack formal financial education or certifications. This lack of credentials and regulation can lead to the spread of misinformation, as social media platforms are vast and fast-moving, making it difficult to police content effectively.

MSN highlights that a significant portion of Gen Z looks to TikTok finfluencers for financial advice. While these influencers can make financial advice more accessible, there is a risk that young adults may not be saving as much as they could if they relied on more traditional financial advice. The article also emphasizes the importance of teaching young people to critically evaluate the financial advice they encounter on social media. A study from the Financial Industry Regulatory Authority (FINRA) found that 60% of younger investors use social media as a source of investment information, compared to 35% of those between 35 to 54 and only 8% of those 55 and older.

(click image to expand)

Source: CFA Institute, The Finfluencer Appeal: Investing in the Age of Social Media

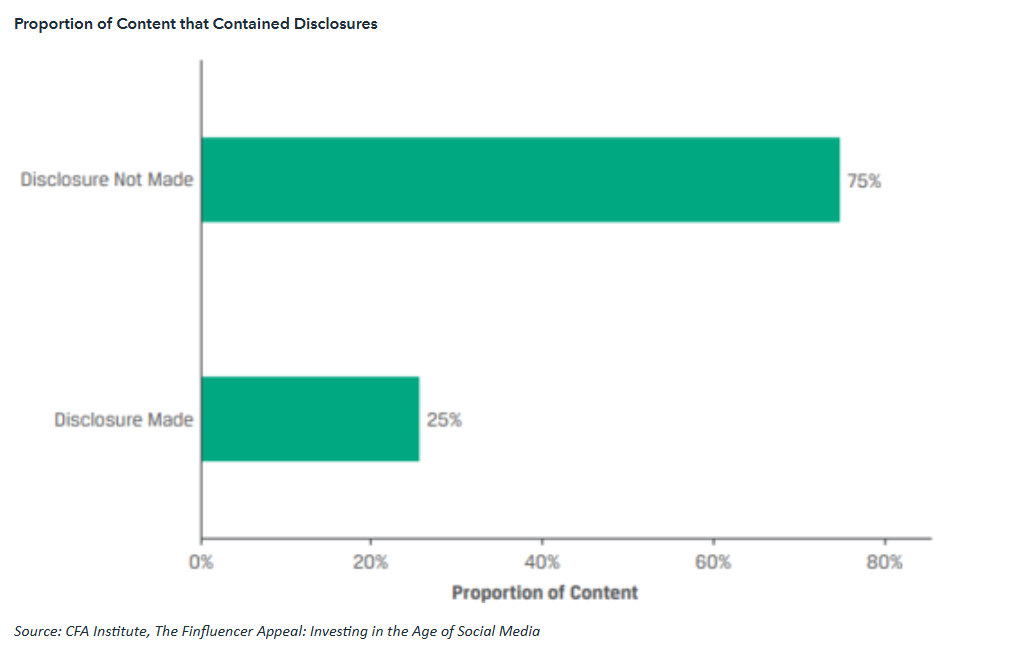

While many of these influencers provide valuable information, there is a growing concern about the potential for misleading investors. One way financial influencers can mislead investors is through the promotion of specific stocks or financial products without disclosing their own financial interests. For example, an influencer might recommend a particular stock because they hold a significant position in it and stand to benefit from a price increase. This lack of transparency can lead investors to make decisions based on biased information, ultimately resulting in financial losses.

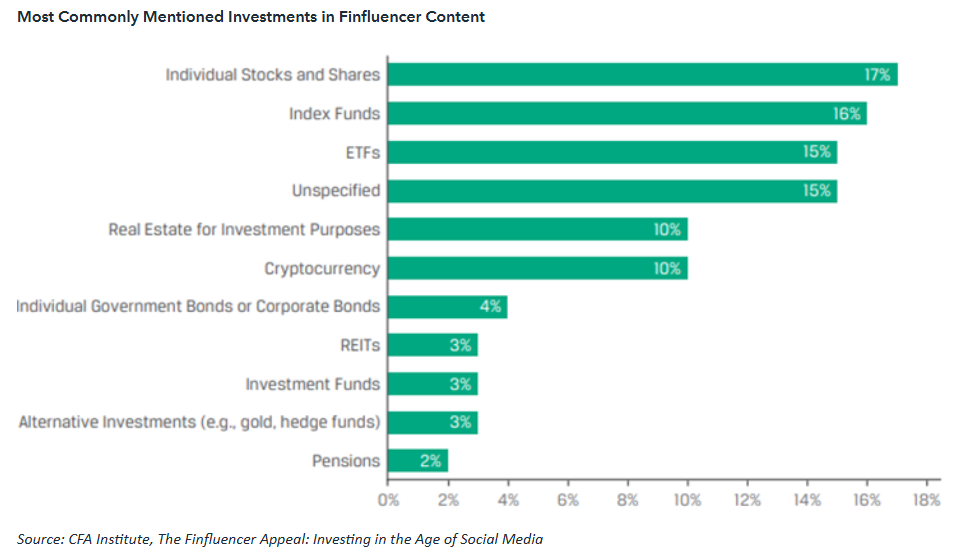

(click image to expand)

Another way finfluencers can mislead investors is by oversimplifying complex financial concepts. Investing is inherently risky and requires a thorough understanding of market dynamics, financial instruments, and risk management strategies. However, some influencers may present investment opportunities as “sure bets” or “guaranteed returns,” downplaying the associated risks. This can create unrealistic expectations among investors, who may then make poorly informed decisions. Additionally, the use of sensationalist language and hype can drive irrational behavior, such as panic buying or selling, which can further exacerbate market volatility.

(click image to expand)

Furthermore, there are regulatory challenges related to the location of finfluencers and their audience. The Securities and Exchange Commission (SEC) has jurisdiction over investment advice provided to U.S. investors. However, if an influencer is based in a different country, the SEC’s ability to enforce regulations becomes complicated. Similarly, investors acting on advice from influencers located outside their own country may face difficulties in seeking recourse if the advice leads to financial losses. This jurisdictional issue can create a regulatory gap, leaving investors vulnerable to misleading information without adequate protection.

Moreover, financial influencers can mislead investors by providing advice that is not tailored to individual circumstances. Every investor has unique financial goals, risk tolerance, and investment horizon. Generic advice that does not take these factors into account can be detrimental. For instance, an influencer might advocate for aggressive investment strategies that are unsuitable for risk-averse individuals or those nearing retirement. This one-size-fits-all approach can lead to inappropriate investment choices and potential financial hardship.

While financial influencers can offer valuable insights, it is crucial for investors to approach their advice with caution. Conducting independent research, seeking advice from licensed financial professionals, and considering one’s own financial situation are essential steps to making informed investment decisions. Additionally, being aware of the regulatory challenges related to the location of influencers and investors can help mitigate potential risks.

Week Ahead…

As we look ahead to the coming week, the Conference Board will release the consumer confidence index on Monday. Following the sharp downturn in consumer sentiment last week, economists are intrigued to see whether the confidence index mirrors this trend.

On Wednesday, we can expect the data for new home sales. After a surprisingly strong showing earlier in the year, economists will be watching to see if the upward momentum continues, especially considering the decline in existing home sales this month.

Thursday brings the preliminary estimate of gross domestic product (GDP), which the market will focus on sharply, particularly if there are any significant revisions from last month’s advanced estimates.

Finally, we will wrap up the week with the Personal Consumption Expenditure (PCE) data on Friday. This report is the Federal Reserve’s preferred gauge of inflation, and it will be closely watched by economists and investors alike.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.

Securities offered through Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC, and investment advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Both are wholly-owned subsidiaries of Cambridge Investment Group, Inc. V.CIR.0225-0720