Week in Review…

Most market indices closed the week lower as new U.S. data sparked concern among investors over a slowing economy and sticky inflation, leading them in search of safer assets.

- The S&P 500 declined by -0.98%

- The Dow Jones Industrial Average increased by 0.95%

- The tech-heavy Nasdaq declined by -3.47%

- The 10-Year Treasury yield closed at 4.25%

Last week, a slew of housing reports provided the market with a clearer understanding of the sector, but the data did not inspire much confidence.

On Wednesday, January New Home Sales data came in weaker than expected at 657,000 units, compared to the estimated 679,000 units. This was a significant drop from last month’s figure of 734,000 units, representing a decline of 10.5%. Building permits, a key indicator for future housing starts, were revised lower. Although the data came in higher than initially projected, this revision diminishes the previous week’s outperformance and may prompt markets to re-evaluate future projections.

Additionally, January Pending Home Sales month-over-month numbers declined by 4.6%, exceeding expectations of a 0.9% decline. This marked the second consecutive month of declining volume, with both January and December experiencing declines greater than 4%. In the background of this housing data was the sharp rise in 30-year mortgage rates, which bottomed in mid-December at 6.60% and peaked in mid-January at 7.04%, before ending the month at 6.95%. February has seen a steady decline in rates, and markets will closely monitor future reports to gauge how much demand lower rates might release.

Speaking of interest rates, markets observed movements in yields in the middle of the curve this week as 2-, 5-, and 7-year notes were auctioned off. Across the board, yields fell compared to last month. This decline in yields could be attributed to various factors, including sluggish housing data, weakening consumer confidence, and modest Q4 GDP data.

Perhaps the best news for markets last week came on Friday, as the Core Personal Consumption Expenditure (PCE) Price Index was in line with analyst expectations. January’s year-over-year numbers came in at 2.6%, significantly lower than December’s reading of 2.9%. This benign reading may help alleviate some of the inflation and stagflation fears that had been brewing since the hotter-than-expected Consumer Price Index (CPI) reading earlier this month.

The fall in yields and middling inflation numbers can be interpreted in various ways. Some might attribute it to the recent housing data, consumer confidence figures from Tuesday, and the modest Q4 GDP data influenced by personal spending. However, one week of data does not establish a trend, and markets will continue to look for emerging patterns.

Spotlight

The Evolution and Implication of the Commercial Real Estate Maturity Wall

Rising interest rates by the Federal Reserve, coupled with shifts in the post-pandemic landscape, continue to place significant strain on commercial real estate (CRE) mortgages, which are grappling with refinancing difficulties. The concept of the “maturity wall” within the CRE mortgage sector has been a topic of concern since the early stages of this cycle. The primary worry is that upcoming loan maturities could hinder borrowers’ efforts to refinance or alter their loans in a capital market that is increasingly costly and restrictive. Following up on this theme that was discussed in summer of 2023, in this spotlight, we will delve into how this narrative has developed over time and provide investors with a clearer understanding of the implications of the “maturity wall.”

(click image to expand)

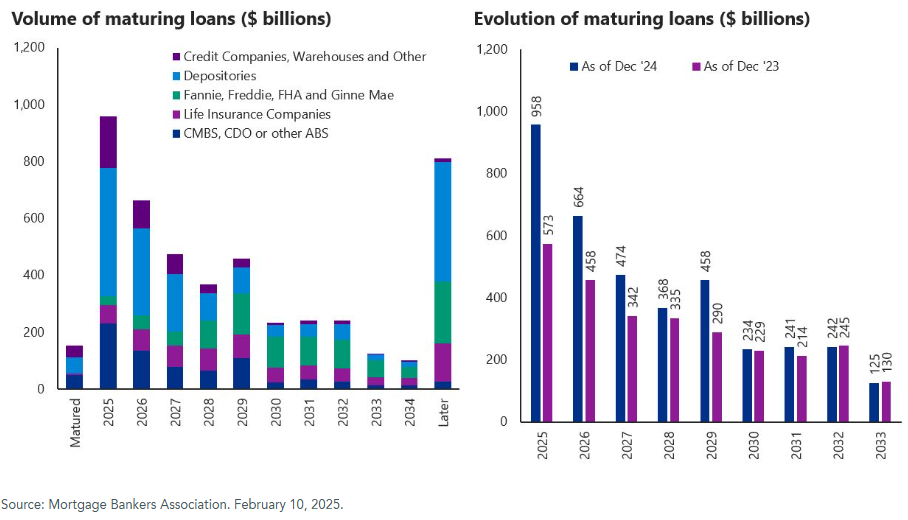

It is important for investors to understand the size and different players of the CRE debt market:

- As of Q3 of 2024, according to the Mortgage Bankers Association (MBA), the CRE mortgage market for income-producing properties is approximately $4.75 trillion

- A variety of lender types contribute capital to the sector, with the largest sources being depositors (banks and thrifts) and government-sponsored enterprises (GSE), which together account for over half of the commercial real estate (CRE) market. Following them are life insurance companies, commercial mortgage-backed securities (CMBS), collateralized debt obligations (CDOs), asset-backed securities (ABS), and other credit firms.

- In addition, investors should be aware that CRE mortgages have a weighted average maturity of seven years, which means about 14% of the entire mortgage universe is expected to mature every year for any year. Given the $4.75 trillion market size of CRE mortgages, that translates to roughly $650 billion of CRE mortgages will mature on average annually, and $1.95 trillion to mature over the next three years.

With this context in mind, the maturity of $958 billion over the next year and $2.1 trillion over the next three years is not far off from what we may typically expect to see each year.

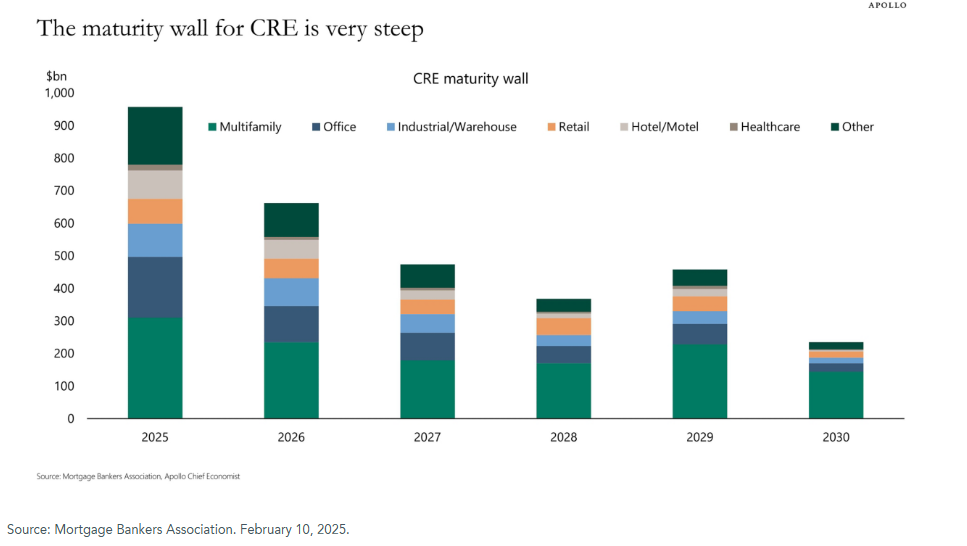

When examining the maturity wall by property type, we still see areas of distress that are likely to emerge as these loans come due. The office sector raises particular concerns, continuing to struggle with the impact of post-Covid work-from-home and hybrid work policies. Notably, 24% of all office loans are set to mature in 2025, unless they are extended. Other sectors will also encounter their own distinct challenges, influenced both by capital market conditions and fundamental factors.

(click image to expand)

Considering where we are in the current economic cycle, the delinquency rate in the CRE market may worsen before it improves, especially as more loans approach their maturity dates. However, the level of distress may not be as severe as the market has anticipated. This is largely due to stronger underwriting standards established since the GFC, as well as loan modifications and extensions, and solid property fundamentals. The most significant distress is expected to manifest in loans secured by office properties, floating-rate loans, and short-term loans which originated during the peak pricing of 2022.

The CRE maturity wall situation presents a mixed outlook, with some experts such as PIMCO noting positive signs in certain sectors while cautioning against expectations of a rapid recovery. Regulatory changes may be implemented to manage banks’ CRE exposure, and Federal Reserve actions could provide some relief to borrowers, though pre-pandemic interest rates are unlikely to return soon. The implications for investors vary, with REITs potentially facing challenges due to declining property values, especially in the office sector, while private equity firms might find opportunities in distressed assets. In general, individual investors may exercise caution in these uncertain markets, where risks and opportunities coexist depending on specific property types and locations.

(click image to expand)

Week Ahead…

Next week, several key economic indicators will be released, providing valuable insights into the health of the economy.

The ISM Manufacturing Purchasing Managers’ Index (PMI) and Services PMI will offer a snapshot of business conditions in the manufacturing and services sectors, respectively. The Manufacturing PMI is forecasted to be higher than the previous reading at 51.6, indicating potential expansion in the manufacturing sector. In contrast, the Services PMI is forecasted to be lower than the previous reading at 49.7, suggesting a contraction in the services sector. The ADP Nonfarm Employment Change report will give an early indication of private-sector employment trends, while the Initial Jobless Claims report will provide a weekly update on the number of individuals filing for unemployment benefits. Furthermore, the Average Hourly Earnings report from the Bureau of Labor Statistics will provide insights into labor market conditions and wage growth, which is anticipated to increase by 0.3%.

In the energy sector, the Baker Hughes Oil Rig Count will be closely watched for insights into drilling activity and future production levels. These indicators, along with the analysis of credit spreads, currency trends, and yield curve positioning, will help investors and policymakers assess the overall economic landscape and make informed decisions.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.

Securities offered through Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC, and investment advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Both are wholly-owned subsidiaries of Cambridge Investment Group, Inc. V.CIR.0325-0813