Broad equity finished mostly higher for the short trading week.

- The S&P 500 was up for the week, gaining 0.61%

- The Dow Jones Industrial Average was up by 1.45%

- The Nasdaq Composite finished flat at 0.00%

- The 10-Year Treasury closed at 4.25%

The week was relatively light in terms of economic releases with markets being closed for the Juneteenth holiday on Wednesday.

Poor retail sales figures released on Tuesday suggested that households are starting to rein in spending. The latest figures for the month of May showed a rise of 0.1%, which was less than the expected 0.3% increase. Core retail sales, which exclude autos, declined by -0.1% compared to the 0.2% expected increase. That same day, business inventories for the month of April were released. The figures showed a 0.3% increase which was right in line with expectations.

Rounding out the week, S&P Global released the Manufacturing Purchasing Managers’ Index (PMI) and the Services PMI for the month of June, revealing that both sectors continue to be in expansion territory. Separately, the housing market gave mixed signals with existing home sales for the month of May beating the forecasted 4.08 million units with 4.11 million sales for the month. However, housing starts fell 5.5% from April and 19% year-over-year.

Consumer Spending Trends

The U.S. Federal Reserve (the Fed) has emphasized that its interest rate decisions will be increasingly data-dependent. The Fed has stated that it will not consider any economic data in isolation, but will instead piece together various indicators to obtain a comprehensive view of the economy’s overall direction to determine its monetary policy.

The three primary criteria that the Fed considers are inflation, the labor market, and economic growth. This week, investors gained insights into consumer spending, which constitutes about two-thirds of the United States’ gross domestic product (GDP). The retail sales report released by the Census Bureau indicated a headline number rising by 0.1% for May, compared to the expected 0.3% increase in consumer spending. The core retail sales figure showed a decline of 0.1%, below the anticipated 0.2% increase.

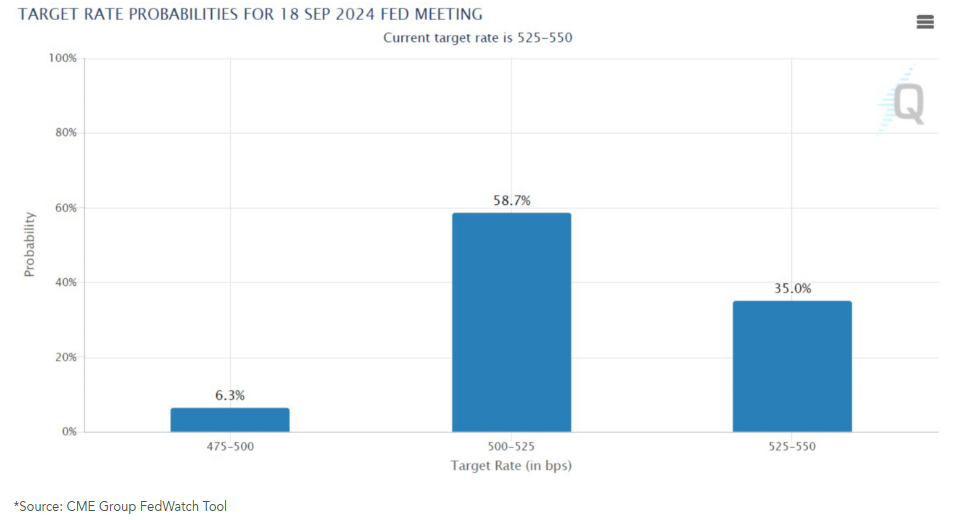

These discrepancies suggest that economic activity may be slowing in the second quarter, potentially strengthening expectations that the Fed might start cutting interest rates as soon as September. According to the CME Group’s FedWatch tool, the probability of a rate cut was 65% at the end of last week, with a 25-basis point cut being the most likely scenario.

Last month, earnings calls from major retailers such as Walmart and Target revealed that consumers are still grappling with higher inflation and interest rates. Walmart noted during its earnings call that customers are spending more on necessities while reducing expenditures on discretionary items like home furnishings and electronics. The retailer also observed that shoppers are increasingly purchasing food storage items as they focus on eating at home to save money.

The retail sales report also showed a 0.4% decline in sales at food services and drinking places, marking the biggest drop since January of this year. Economists often cite dining out as a key indicator of household finances. Ellen Zentner, chief U.S. economist at Morgan Stanley, remarked, “This category has broadly been losing momentum as households pull back discretionary spending and move back towards eating at home.” This trend aligns with the observations of major retailers regarding consumer behavior.

Investors will soon receive another significant data point on overall economic growth when the Bureau of Economic Analysis releases its third estimate of Q1 GDP growth on Thursday.

The Conference Board’s (CB) Consumer Confidence report will be released towards the beginning of the week. The CB report has shown a steady decline since January, with only a small surprise to the upside in May’s measure.

Durable goods orders on Thursday will shed light into the industrial side of the U.S. economy. Durable goods represent industrial goods orders on items with an expected life of three years or greater. Durable goods orders are expected to decline by -0.1% for the month of May while core orders, which exclude transportation items, are expected to increase by 0.1%. That same day, the Bureau of Economic Analysis will provide an updated estimate of Q1 GDP which is expected to show a 1.4% increase.

On Friday, the Personal Consumer Expenditures (PCE) index, the Fed’s preferred inflation measure, will be released. Inflation has been stickier than expected and is taking some time to reach the Fed’s long-term target of 2%. Investors will be interested to see if the numbers show a decline relative to the 0.3% month-over-month and the 2.7% year-over-year numbers for the month of April.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.