- The S&P 500 was up for the week, gaining 1.54%

- The Dow Jones Industrial Average was up 1.24%

- The Nasdaq Composite finished higher by 2.11%

- The 10-Year Treasury closed at 4.42%

Tuesday, the latest Producer Price Index (PPI) measure rose 0.5% month-over-month, which was hotter than expected. Rising input costs could impact consumer prices, making the overall cost of goods and services rise as well. Additionally, the Consumer Price Index (CPI) for the month of May increased just 0.3%, which was lower than April’s 0.4% increase. This slight decrease in month-over-month change compared to the previous month’s reading has investors wondering if the Fed is not likely to cut rates this year now.

Rounding out the week, building permits from April were released, setting the foundation for future housing starts. The recent reading came 40,000 under the forecasted number, disrupting the recent bullish market trend at just 1.44 million permits for the month. Additionally, the Philadelphia Fed Manufacturing Index was released for the month of May, depicting a significant decrease in working conditions by showing a reading of about half the forecasted number, and almost four times less than the previous month’s reading. Economists will be watching to see if this trend continues.

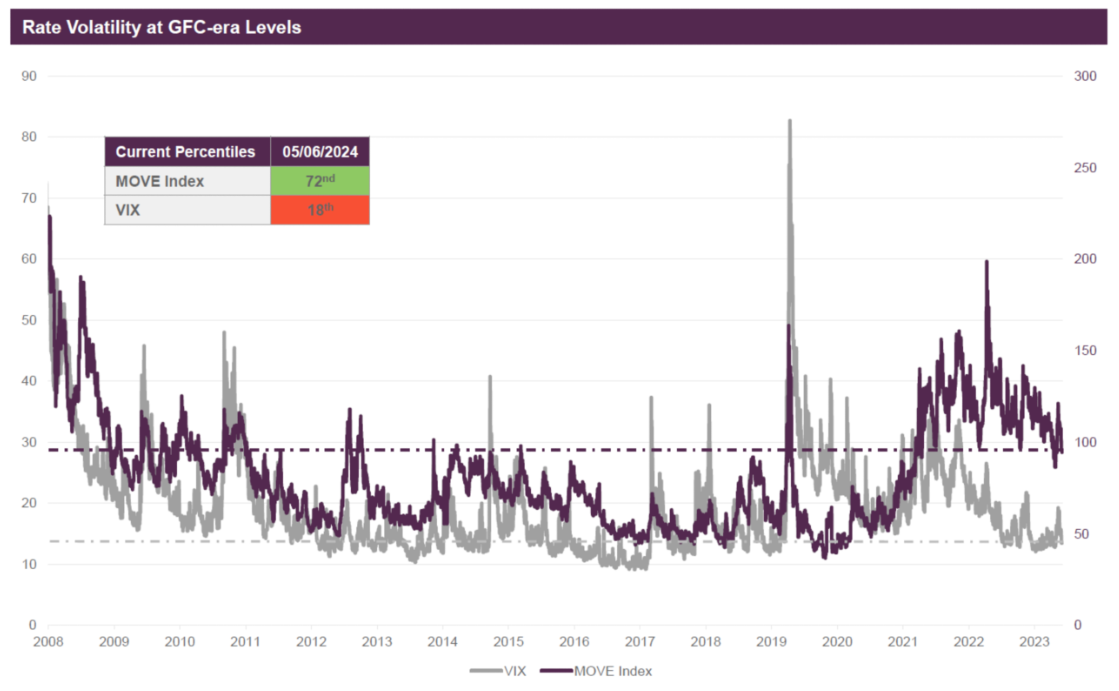

A Quick Primer on the MOVE Index

When equity investors get concerned about volatility in the market, one of the common indicators they focus on is the CBOE Volatility Index (VIX). But what do bond investors look at to determine overall volatility in the market? Most would say changes in credit spreads, but as interest rate volatility concerns have been top of mind, fixed income investors are turning their attention to the Merrill Option Volatility Estimate (MOVE) Index.

The MOVE index was created in by Harley Bassman (also known as the Convexity Maxen) in 1994 when he was at Merrill Lynch. In 2017, Merrill Lynch (Bank of America) sold their fixed income index platform, which included MOVE, to the Intercontinental Exchange. The goal of the MOVE Index is to measure the expected short-term volatility in the U.S. Bond Markets.

MOVE determines implied volatility by looking at the option prices of various U.S. Treasury futures, ranging from 2-, 5-, 10-, and 30-year Treasuries. The implied volatility of the options are calculated and averaged to create the index value. A high value implies higher uncertainty and volatility in the Treasury market and vice versa.

Source: Guggenheim Investments. Data as of 5/6/2024.

Why It Matters Now

As can be seen in the chart above, the MOVE Index has been steadily increasing over the last two years when the Fed began its interest rate hiking regime. The MOVE Index has not been this consistently high since the 2008 great financial crisis. As inflation concerns have been the story for the past two years, volatility and uncertainty have grown in treasury markets. Another thing to note about the MOVE Index is that bond volatility does not move in tandem with equity volatility, with March 2020 being the one notable exception. Despite bond volatility being higher since 2022, volatility in equities has continued to decline over time to near lows not seen since pre-Covid.

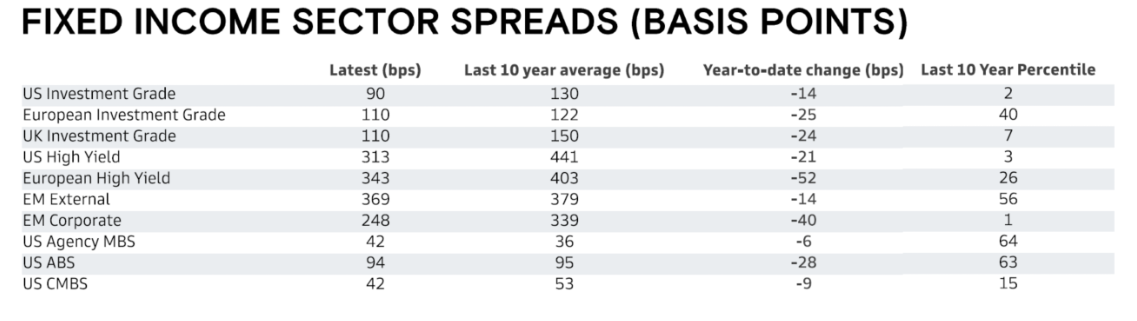

Going forward, fixed income investors should continue to keep an eye on the MOVE Index as the Fed navigates its next steps in potentially cutting rates in 2024 and 2025. Any misinterpretation by investors of the Fed’s direction could see more bond volatility spikes like we saw in 2023. Additionally, as spreads have continued to tighten year to date, bond investors will be cautious of not only volatility in Treasuries but also any widening of spreads in different bond sectors, specifically the historically tight corporate bond sectors.

Source: Macrobond, Goldman Sachs Asset Management, ICE BofAML, and J.P. Morgan. Data as of 5/16/24

Initial jobless claims for the week will be released on Thursday, indicating if the labor market is hot or cold. The previous two weeks have shown an increased number of individuals filing for unemployment for the first time, stipulating a bearish market.

Also on Thursday, Markit will release the services and manufacturing purchasing managers’ index (PMI), measuring the conditions of the services and manufacturing sectors. The previous month’s readings for both sectors have shown that they are in expansion territory. Economists will be watching to see if this continues.

Friday will see durable goods orders for the month of April released, measuring the change in the total value of new orders for manufactured goods. The previous two readings have shown a trend of increased spending on these long-lasting goods, indicating a hot market.

The U.S. Baker Hughes oil rig count will be released on Friday as well, indicating if oil prices will be increasing or decreasing. Additionally, crude oil inventories will be measured by the Energy Information Administration (EIA) regarding the weekly change in the number of barrels held by U.S. firms. An increase in inventories implies a weaker demand for oil; however, a decrease in inventories implies an increase.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.